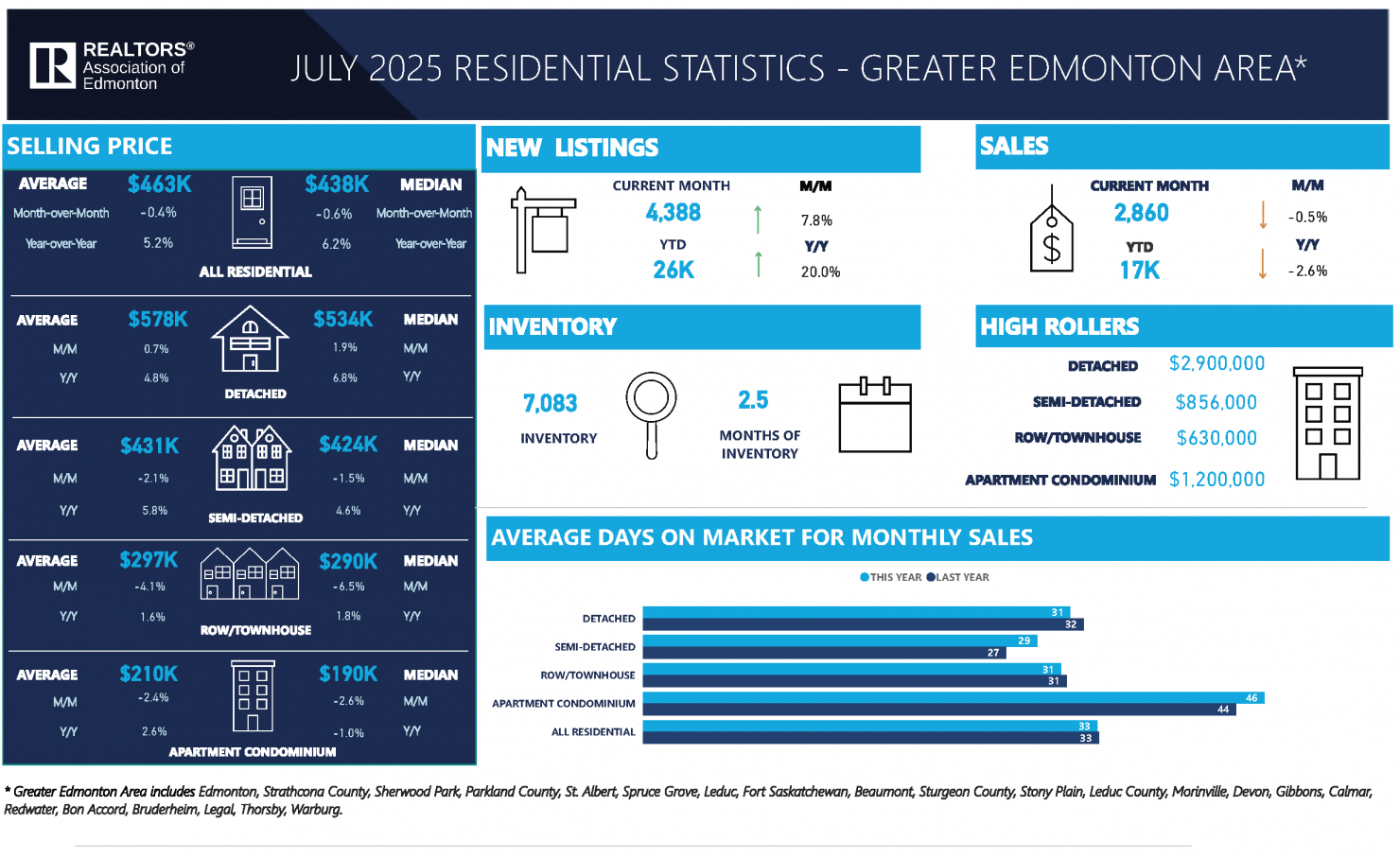

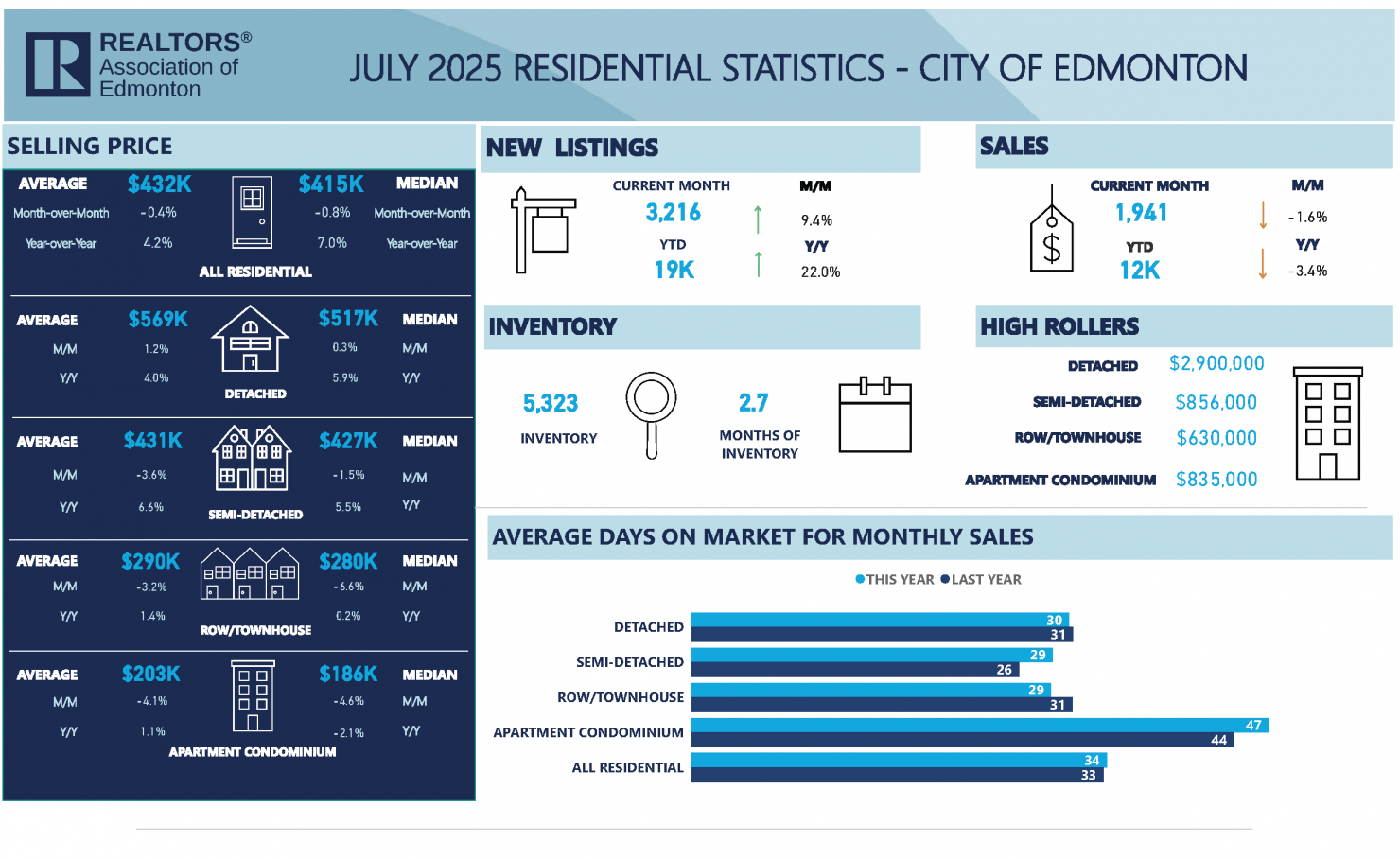

Edmonton, AB – August 1, 2025 — Activity in the Greater Edmonton Area (GEA) real estate market mostly kept pace with June 2025, selling 2,860 units in July, a month-over-month decrease of 0.5%, but new listings outpaced sales as 4,387 properties were added to the REALTORS® Association of Edmonton’s (RAE) MLS® System, an increase of 7.8%. Year-over-year comparisons painted a clearer picture of the shift in the GEA market, with residential unit sales down 2.6% and new listings up 20.0% from July 2024. With sales lagging and new listings plentiful, inventory levels also trended up, with 7,083 properties available at the end of the month, up 4.7% from June and 21.8% higher than July last year.

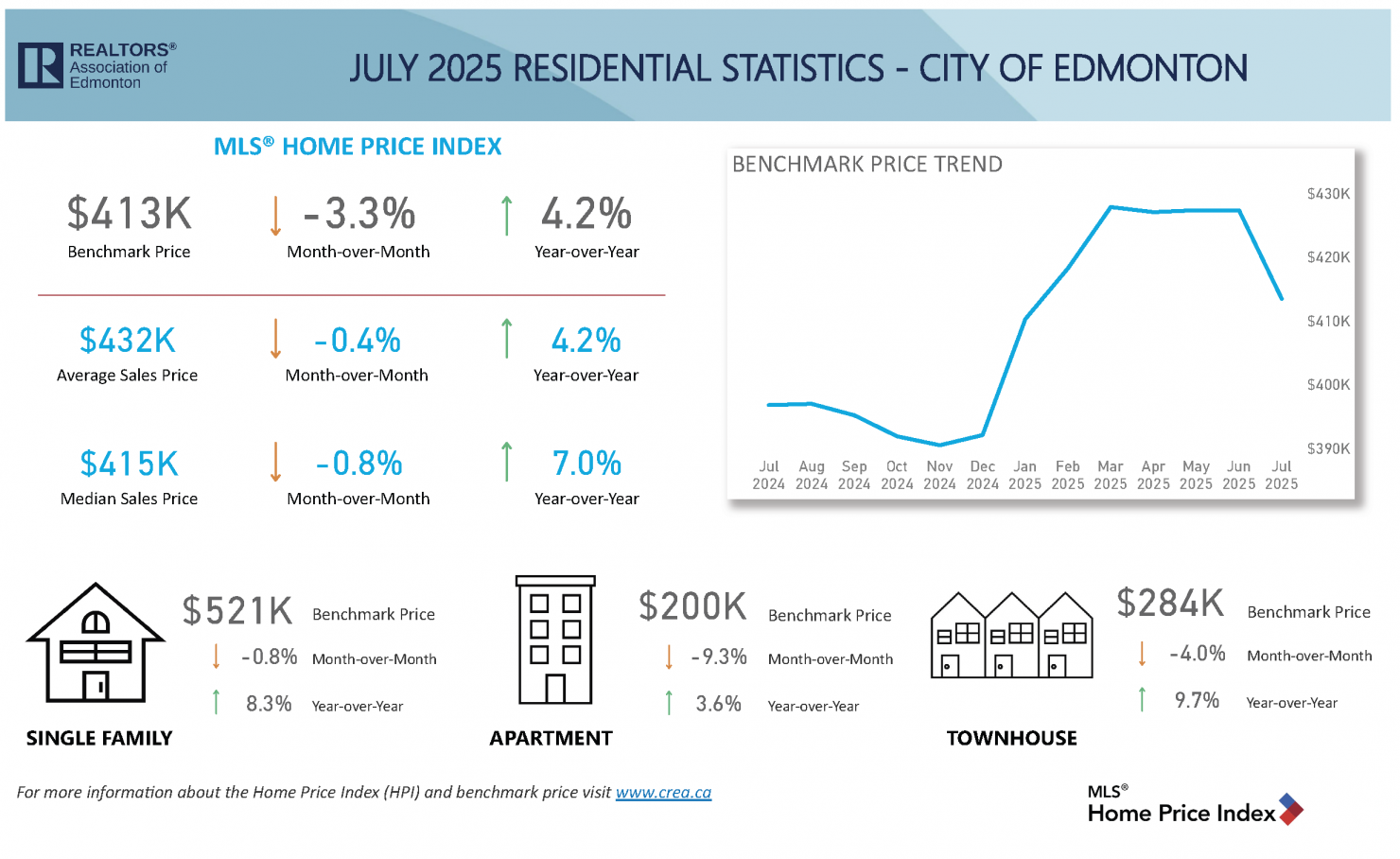

The average selling price across all residential property types decreased 0.4% from June to $463,078, a price 5.2% higher year-over-year. The MLS® Home Price Index (HPI) composite benchmark price in the GEA was $427,800, reflecting a 2.7% decrease from June 2025 and a 5.2% increase from July 2024.

Data by Property Type

Detached homes average prices increased 0.7% month-over-month to $578,442, bucking the short-term trend compared to other property types, while the year-over-year change increased 4.8%. New detached listings were 3.0% higher than in June, and 19.7% higher than July 2024. Meanwhile, detached unit sales decreased 0.5% month-over-month and 0.8% year-over-year.

Semi-detached property prices fell 2.1% from June 2025, to $430,813, a price that is still 5.8% higher than July 2024. Sales also slowed for semi-detached homes, sitting 0.3% lower than the previous month and 2.9% lower than the previous year. July 2025 added 34.1% more new semidetached listings than the previous year and 0.7% more than the previous month.

Row/townhomes also added plenty of new listings, with 13.0% more properties listed month-over-month and 21.1% more year-over-year. Sales in this category showed the sharpest drop of all, slowing 4.3% compared to June and 6.6% compared to July 2024. Row/townhouse prices also fell in July, averaging at $296,785, a 4.1% monthly decrease and only increasing 1.6% over the previous year.

Apartment condominiums sales were strong, increasing 3.5% from June, though activity is still 4.8% lower than the previous year. Condominium prices fell 2.4% from the previous month, but continue to increase year-over-year at $209,711 — an average price 2.6% higher than July 2024. Newly listed apartment condos increased 3.2% from June and 13.9% from July 2024.

Follow us on:

Google+ Facebook Twitter YouTube Email