“… Your home is your castle .. even when it’s for sale…”

Let’s say your terms are competitive: your timing’s clearly set. Now, what about your asking price?

Without question, price is your most important sales tool. Here’s why:

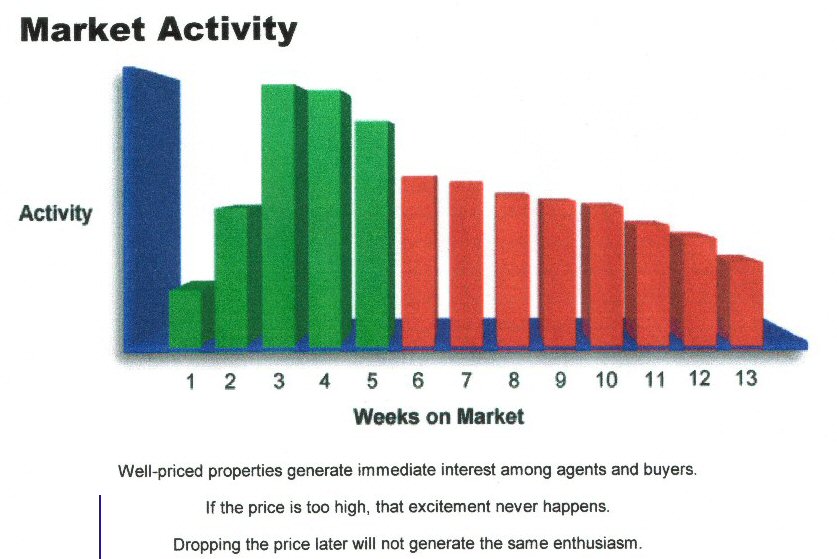

The period of best opportunity for selling a home at a reasonable price is the first four weeks after it is put on the market. Buyers who have seen most available listings are waiting for just the right house to come on the market. If your house is priced right from the beginning, you are in the best position to attract the maximum number of buyers able to pay the price your home is worth – and to sell your home within your timetable.

.. If your house is under priced, you may be swamped with lookers and perhaps get many offers. But you could lose thousands on one of your family’s largest investments.

.. If your house is overpriced, lookers are apt to be few and far between, with little chance of any offers to pay your unrealistic price. You may lower your price later, but by that time you will have missed many of the most interested buyers.

How do you Set the Right Price?

Arriving at an asking price involves up-to-the-minute research and experienced judgment. Besides enlisting my help in checking out the current real estate market conditions and financing trends, the basic steps include:

.. Measuring your home against similar neighborhood homes that have recently been sold or are currently on the market.

.. Determine what features make your house stand out among others currently on the market. After all, buyers are comparison shoppers. Weighing the spending of a reasonable amount of money on cosmetic fix-ups that might enhance the marketability of your house and earn the highest possible sale price.

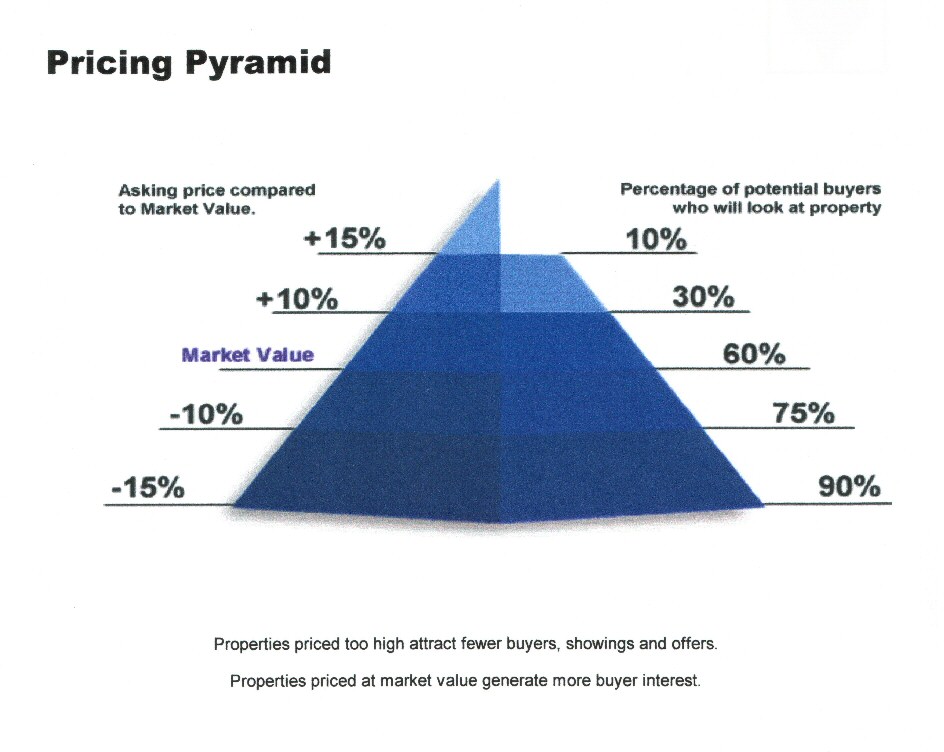

The right price is usually within 5% of market value (a constantly changing factor) and usually results in a fair-dollar sale within a reasonable amount of time. As we say, “price sells.”

Why is overpricing risky?

A price more than 5% over market value may have these results:

.. Buyers may resist inspecting your home because they can find better values elsewhere.

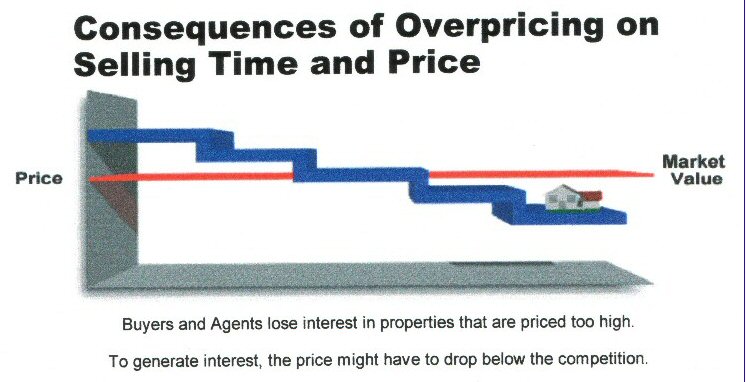

(Overpriced houses tend to sell the competition first.)

.. Potential buyers who can’t afford the price don’t bother to look–or to make offers.

.. A buyer willing to pay an over market price may have difficulty getting financing. Lenders may not approve a loan if the appraisal is lower than the contract price. (The delay from a failed sale can mean missing out on the critical first 30-day marketing period.)

.. Your unsold home will begin to get “stale,” as the marketplace assumes there is “something wrong” with the house.

.. To make up for lost time you might be inclined to lower the price below competing houses in order to move it.

Is it Ever Smart to Under Price?

Setting a price below market value usually isn’t preferable because you may be losing money. If time is more important than money and you need a faster-than-average sale, you may consider setting a bargain price to attract the greatest number of prospects. Market value delivers the optimum number of prospects at the best price for a quick sale.

When you’re ready to sell your home, take advantage of my real estate expertise to help you price your home to sell.

Download this report by clicking on the link below.

Latest Blog Entries

Numbers Give Clear Indication That Spring Market Has Begun

Apr 10, 2024 | by Peter KubiczekMarch, 2024: There were a total of 2,467 residential unit sales in the Greater Edmonton Area (GEA) real estate market for March 2024, showing increases of 25.6% over February 2024, and 35.7% over March 2023. New residential listings amounted to 3,597, a number 32.4% higher than in February 2024, and 8.9% higher than March 2023. Overall inventory in the GEA increased 10.7% from February 2024, but is still 15.4% lower than March 2023.

Read More...

Housing Market Heating Up for an Early Spring

Apr 10, 2024 | by Peter KubiczekFebruary 2024: There were a total of 1,966 residential unit sales in the Greater Edmonton Area (GEA) real estate market for February 2024, showing increases of 36.9% over January 2024, and 52.6% over February 2023. New residential listings amounted to 2,762, a number 27.7% higher than in January 2024, and 9.3% higher than February 2023. Overall inventory in the GEA increased 5.8% from January 2024, but is still 14.3% lower than February 2023.

Read More...

View all posts >>

Market News

Numbers Give Clear Indication That Spring Market Has Begun

Apr 10, 2024 | by Peter KubiczekMarch, 2024: There were a total of 2,467 residential unit sales in the Greater Edmonton Area (GEA) real estate market[...] Read More...

Housing Market Heating Up for an Early Spring

Apr 10, 2024 | by Peter KubiczekFebruary 2024: There were a total of 1,966 residential unit sales in the Greater Edmonton Area (GEA) real estate market[...] Read More...

Slow And Steady Numbers a Good Sign for 2024

Apr 10, 2024 | by Peter KubiczekJanuary, 2024: Total residential unit sales in the Greater Edmonton Area (GEA) real estate market for January 2024 came to[...] Read More...- Single Family Detached - Average Selling Price $517,131 Up 1.7%from M/M andUp 6.7%Y/Y

- Townhouse Condominium - Average Selling Price $282,557 Up 2.5%from M/M andUp 13.9%Y/Y

- Apartment Condominium - Average Selling Price $194,101 Up 7.0%from M/M andUp 0.6%Y/Y

- All Residential - Average Selling Price $420,959 Up 3.4%from M/M andUp 8.0%Y/Y

- Average Days on the Market - All Properties 39, Detached Homes 40, Semi-detached 35, Townhouse Condominiums 34, Apartment Condominiums 47,

- Total residential LISTED - 3,597 Up 32.4%from M/M andUp 8.9%Y/Y

- Total residential SOLD - 2,467 Up 25.6%from M/M andUp 35.7%Y/Y

- Total residential Active Inventory on MLS - 5,320 Up 10.7%from M/M andDown 15.4%Y/Y.

Testimonials from Happy Clients of THE KUBICZEK TEAM

Peter, thank you for your expertise, professionalism to walk me through the listing and selling process kindness during a critical time while I was undergoing a major surgery and needed a compassionate realtor partnership and support. I have so much to be grateful for these days, and this includes Peter and his team. If you […]

Barbara DeS.

Personal Service. Professional Results.Peter is an excellent realtor. We bought and sold through him. It was never an issue for him to come up to our house to review an offer even at midnight, which in our case he did. He does not cut corner, he is ethical and the next time we sell or purchase Peter and […]

Bernadette & Mark Gislason

Personal Service. Professional Results.

“They are professional with house transactions and willing to help solving other problem. They offered me carpet cleaning machine when we moved and solved my rental problems two month later since we move. It seems they are not only my realtor but also my friends, true friends as well”

Yanying Pi and Family

Personal Service. Professional Results.

Follow us on:

Google+ Facebook Twitter YouTube Email