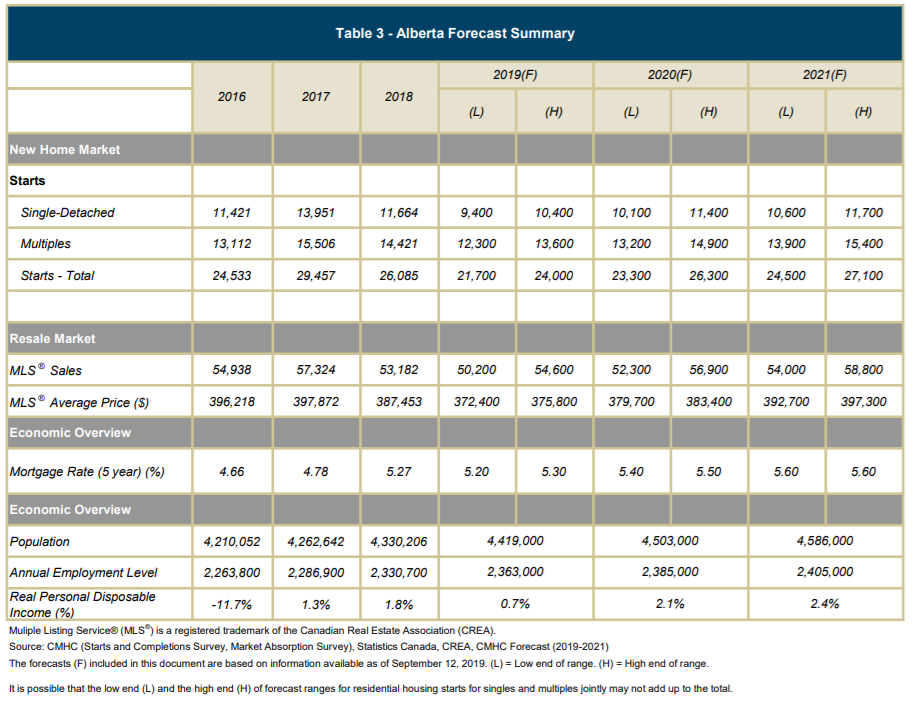

Housing starts to stabilize in 2020 and 2021 at levels in line with the historical average Housing starts are expected to register a second consecutive annual decline in 2019 before stabilizing in 2020 and 2021 at levels closer to the 1985-2018 average by the end of 20213 and well below the 10-year high housing starts recorded in 2017. This will reflect a balance between off-setting economic and demographic developments. In particular, GDP4 growth is expected to soften in 2019 but to recover at or above its potential pace in 2020-2021. However, the support to new residential construction from the expected improvement in economic activity and incomes will be offset by the projected slowing in household formation over the forecast horizon. Mortgage rates are predicted to increase over this horizon, but gradually while remaining at low levels. Consequently, their expected contribution to our housing outlook is negligible. Both single-detached and multi-unit housing starts are forecast to decline in 2019 before essentially stabilizing in 2020 and 2021. As a result, starts of both single-detached and multi-unit housing types will remain below the recent peaks observed in 2017 (for single-detached starts) and 2018 (for multi-unit starts).

Sales to strengthen in 2020 and 2021, offsetting declines in recent years Existing home sales are forecast to stay near their 2018 level in 2019, below the historical peak observed in 2016.6 However, home sales will increase in 2020 and 2021, offsetting the declines observed since 2016 by the end of the forecast horizon. This reflects expectations of household disposable income growth.

Recent moderation in price growth will be reversed by the end of the forecast horizon The average MLS® price is expected to decline for a second consecutive year in 2019 from the recent high registered in 2017.7 However, positive price growth is expected to resume in 2020 and 2021, driving the average price above its 2017 level by the end of the forecast horizon. This is expected to reflect household disposable income growth and rates of household formation that will remain supportive of price growth despite moderating from higher rates in recent years.

Read the entire report HERE..

Follow us on:

Google+ Facebook Twitter YouTube Email